The Addiction That is Crippling Our Industry . . . The Insurance Bid!

Over the past seven years, I have treated over 800 patients at Beyond Insurance Treatment Centers. Our patients are typically bright, well-educated, dedicated, attractive, community-minded producers, sales managers and agency principals who have become addicted to “The Insurance Bid”.

Over the past seven years, I have treated over 800 patients at Beyond Insurance Treatment Centers. Our patients are typically bright, well-educated, dedicated, attractive, community-minded producers, sales managers and agency principals who have become addicted to “The Insurance Bid”.

Our patients enter the two day session frustrated, angered and demoralized. Their confidence and self-image have been rattled. The addiction to The Insurance Bid has them caught in the “commodity trap” – the 90-day insurance bidding process. They are fighting an uphill battle against commoditization.

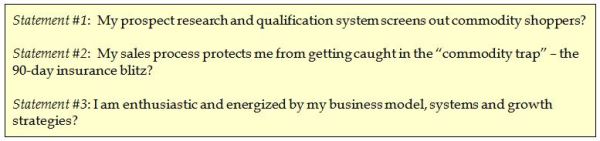

Prior to attending a Beyond Insurance program, each patient is asked to complete a confidential “10 Question Beyond Insurance® Survey”. This Survey facilitates the ability of Beyond Insurance to understand the level of addiction so a treatment plan may be developed. As you can imagine, we see serious cases of “performance erosion” as measured by reduced new business hit ratios, sub standard retention, random cross selling strategies, no referrals and key accounts under renewal competition. The following represent three of the ten statements that are asked on the Beyond Insurance Survey:

Over 80% of the patients at the Beyond Insurance Treatment Centers, respond “no” to the statements listed above. The addiction to The Insurance Bid is impacting their personal and business careers. Addiction is defined as a state intoxication produced by repeated consumption of a drug. Its characteristics include: (1) an overpowering compulsion to continue taking the drug and to obtain it by any means; (2) a tendency to increase the dose; (3) a psychological and generally physical dependence on the effects of the drug; and (4) detrimental effects on the individual and on society”.

Substance Free Strategy

The Beyond Insurance Treatment Plan begins with two potent, soul-searching and enlightening tools – the Diminished Value Snapshot and The Prosperity Gap. Both strategies allow the insurance addict to gain a sense of clarity, simplicity, purpose and passion. For the first time, they are able to see the flaws of The Insurance Bid on their time, reputation, confidence and money.

The Beyond Insurance Treatment Centers are recognized for their ability to use the Risk Management Process as a means of rehabilitation. The Risk Management Process is a systematic methodology for assessing and treating accidental loss exposures. It is the addicted producer’s understanding of, and appreciation for, the Risk Management Process which reduces his or her dependency on The Insurance Bid. The purity and logic of the Risk Management Process shifts the producer’s mindset from insurance to risk and risk management.

Addicted producers gain immediate energy and confidence in their ability to control the outcome of risk. The identification, assessment measurement and prioritization of risks become the therapy for the disorder. Let’s take a close look at the four steps of the Beyond Insurance® rehab process:

Step 1 – Identifying Loss Exposures

Step 1 – Identifying Loss Exposures

The first and most important step of the Risk Management Process involves identifying and analyzing loss exposures that interfere with the achievement of an organization’s goals. Simply put, this step of rehab begins with a curiosity and desire to understand the inner workings of a business. As the insurance addict learns about a business, he or she is positioned to identify and analyze risk issues.

Step 2 – Strategies to Mitigate Loss Exposures

Once the addicted producer has developed a thorough understanding of a business, including its industry, corporate culture and operating procedures, he or she is ready to move beyond insurance to explore strategies to minimize risk and, thereby, reduce insurance costs.

Step 3 – Implementation of Programs

By the time the addicted producer gets to Step 3 of the rehab process, Beyond Insurance sees an amazing transformation. The burden of price and product has been lifted off their back. The former insurance addict now has an appreciation for, and understanding of, risk management. Confidence and self-image are now part of the makeup of the Beyond Insurance Producer.

Step 4 – Ongoing Monitoring and Adjustment of the Plan

Organizations are dynamic. What works today may not work tomorrow. It is for this reason that the Beyond Insurance Treatment Centers prescribe risk management service plans, stewardship reviews and customer intimacy surveys to ensure a perfect fit as a business evolves and changes.

Step 4 of the Beyond Insurance rehab process is most rewarding. It is here where the addiction to The Insurance Bid is put to rest.

Are you concerned about the addiction to the insurance bid in our industry? If so, what treatment plans do you recommend?

Yes, education is indeed the first step. However, the commoditization phenomenon is here thanks to the central purchasing processes, and the sometimes justified hunger of the organizations to constantly reduce costs. So nowadays, a lot of bids are simply decided by people who do not have the slightest idea of what are they buying, based solely on price. A nice introduction here would be the “Total Cost of Risk” concept, which everybody would like to have under control, and doesn’t just account for premium levels. We need to educate the people involved in the bidding processes to understand risk management, because otherwise they will keep on taking decisions based on insufficient parameters.